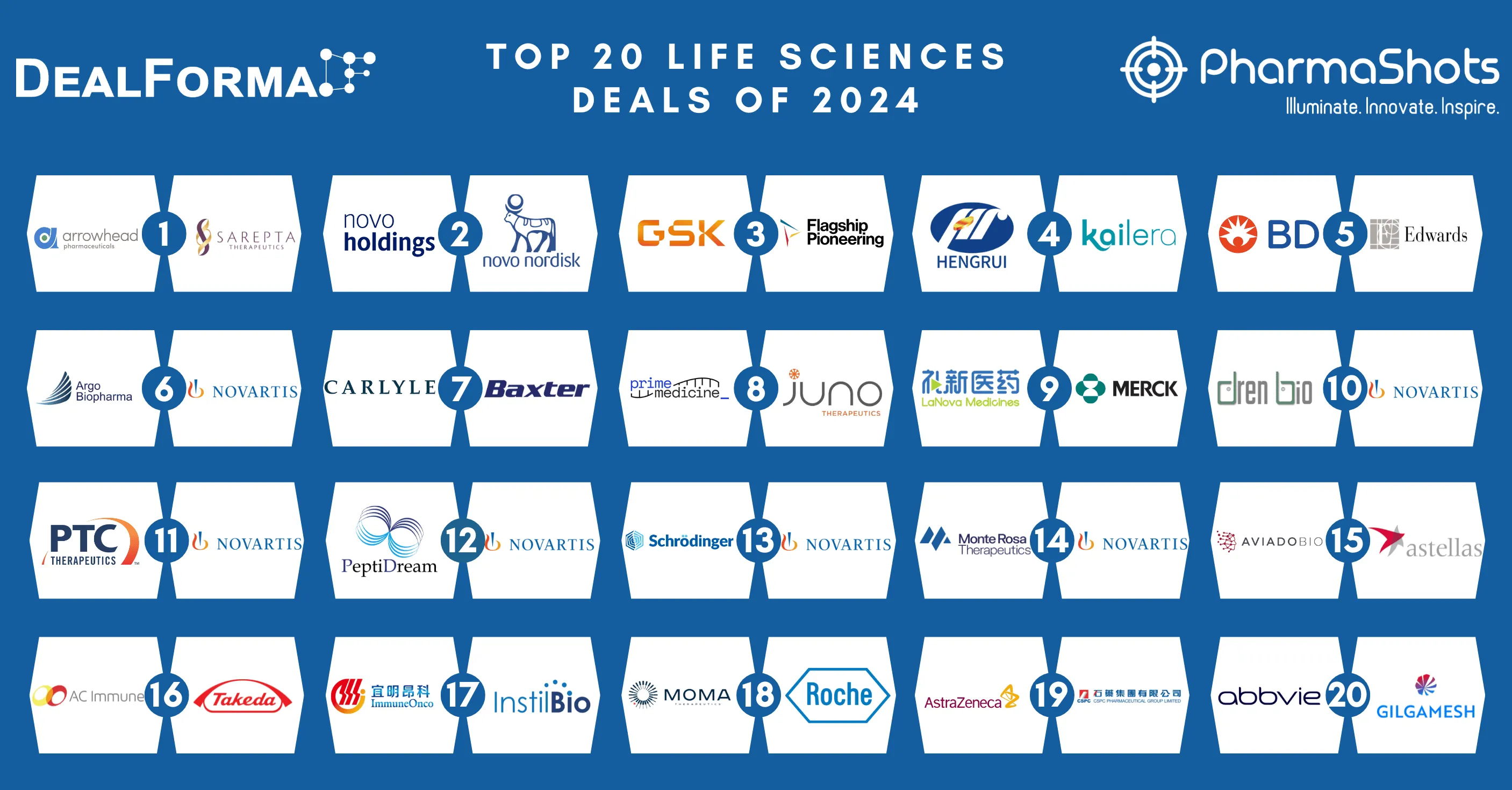

Top 20 Life Sciences Deals of 2023 by Total Deal Value

Shots:

-

Driven by mutual growth and expansion, strategic collaborations are embedded deeply in the modus operandi of life sciences deals. In 2023, the volume of life science deals was comparatively high vs. 2022

-

The collaboration deal between Daiichi Sankyo and Merck & Co. for $22B ranks first in our list followed by the development and commercialization deal between SystImmune & BMS for $8.4B and the agreement inked by Flagship Pioneering & Pfizer for $7.05B

-

With the resourceful insights from DealForma, PharmaShots brings a concise report on the Top 20 Life Sciences Deals in 2023

Eccogene’s Development and Commercialization Deal with AstraZeneca

Deal Date: Nov 19, 2023

Deal Value: $2.01B

-

In Nov 2023, Eccogene signed a development and commercialization agreement with AstraZeneca. Through this agreement, AstraZeneca received the exclusive rights to develop and commercialize Eccogene’s ECC-5004 across the globe for the treatment of Obesity and Type-2 Diabetes, except China

-

Eccogene has the right to co-develop and co-commercialize ECC-5004 with AstraZeneca across China. ECC-5004 is a small molecule GLP-1 receptor agonist developed for the treatment of Obesity and Type-2 Diabetes

-

Under the terms of the agreement, Eccogene will receive an upfront payment of $185M and is eligible for an aggregate of $1.82B in development, regulatory, and commercial milestone payment, plus tiered royalties

Orionis Biosciences’ Multi-Year Collaboration Agreement with Genentech

Deal Date: Sep 20, 2023

Deal Value: $2.05B

-

Genentech entered into a multi-year collaboration agreement with Orionis Biosciences in Sep 2023. The agreement was to discover novel small-molecule medicines for the difficult targets in major disease areas, including Oncology and Neurodegeneration

-

As per the terms of the agreement, Genentech received the exclusive worldwide rights to develop and commercialize small molecule monovalent glue therapies

by leveraging Orionis’ Allo-Glue platform in Oncology and Neurodegeneration indications. Orionis took the responsibility to discover therapeutic products, whereas Genentech got hold of all future activities -

Under the terms of the agreement, Orionis will receive an upfront payment of $47M and is eligible to receive up to $2B in development and commercialization milestones, plus tiered royalties

Belharra Therapeutics’ Development and Commercialization Agreement with Genentech

Deal Date: Jan 1, 2023

Deal Value: $2.08B

-

In Jan 2023, Genentech signed a collaborative agreement with Belharra Therapeutics to discover and develop small molecule therapies in Oncology, Autoimmune, and Neurodegenerative diseases. Genentech received the exclusive rights to develop and commercialize small molecule therapies across the globe. The collaboration combines Belharra’s drug discovery platform with Genentech’s development expertise

-

As per the agreement, Belharra will be responsible for the discovery and early preclinical development, whereas Genentech will be responsible for target selection and late preclinical, clinical, and commercial activities. Moreover, Belharra also has the option to co-develop certain cancer and autoimmune therapies through P-I and co-fund the remaining development in exchange for US cost/profit split and ex-US milestone payments and royalties

-

Belharra will receive an upfront payment of $80M and is eligible to receive an aggregate of $2B in development and commercial milestones, plus tiered royalties

Quell Therapeutics’ Option to License Deal with AstraZeneca

Deal Date: Jun 9, 2023

Deal Value: $2.08B

-

In Jun 2023, AstraZeneca signed a collaborative agreement with Quell Therapeutics to develop multiple engineered T-regulator (Treg) cell therapies for Type 1 Diabetes and Inflammatory Bowel Disease. The collaboration combines Quell’s Foxp3 Phenotype Lock along with AstraZeneca’s expertise in the development and commercialization of therapies for Type 1 Diabetes and Inflammatory Bowel Disease

-

As per the agreement, AstraZeneca received the exclusive option to license to develop and commercialize the resulting therapies across the world, whereas Quell got the responsibility to develop and manufacture the resulting therapies

-

Quell received an upfront cash payment and equity of $85M and is eligible to receive up to $2B in development and commercial milestones, plus tiered royalties. Additionally, Quell has the option to co-develop therapies for Type 1 Diabetes across the US following IND approval or Phase I/II clinical trials in exchange for milestones and royalties

Avidity Biosciences’ Global Licensing and Research Collaboration with BMS

Deal Date: Nov 27, 2023

Deal Value: $2.27B

-

BMS entered into a licensing and research collaboration with Avidity Biosciences in Nov 2023 to discover, develop, and commercialize 5 cardiovascular targets through BMS’ Antibody Oligonucleotide Conjugate (AOC) platform. The agreement replaces the agreement signed between Avidity and MyoKardia (a subsidiary of BMS)

-

Under the agreement, Avidity was responsible for the initial research activities while generating and optimizing AOC compounds on a target-by-target basis and BMS received the rights for all further developments

-

Moreover, Avidity is eligible to receive an aggregate of $2.3B, which includes $60M as up front cash and $40M in up front equity at $7.8 per share. Avidity is also eligible to receive up to $1.35B in R&D milestones and up to $825M in commercial milestones, plus low double-digit royalties

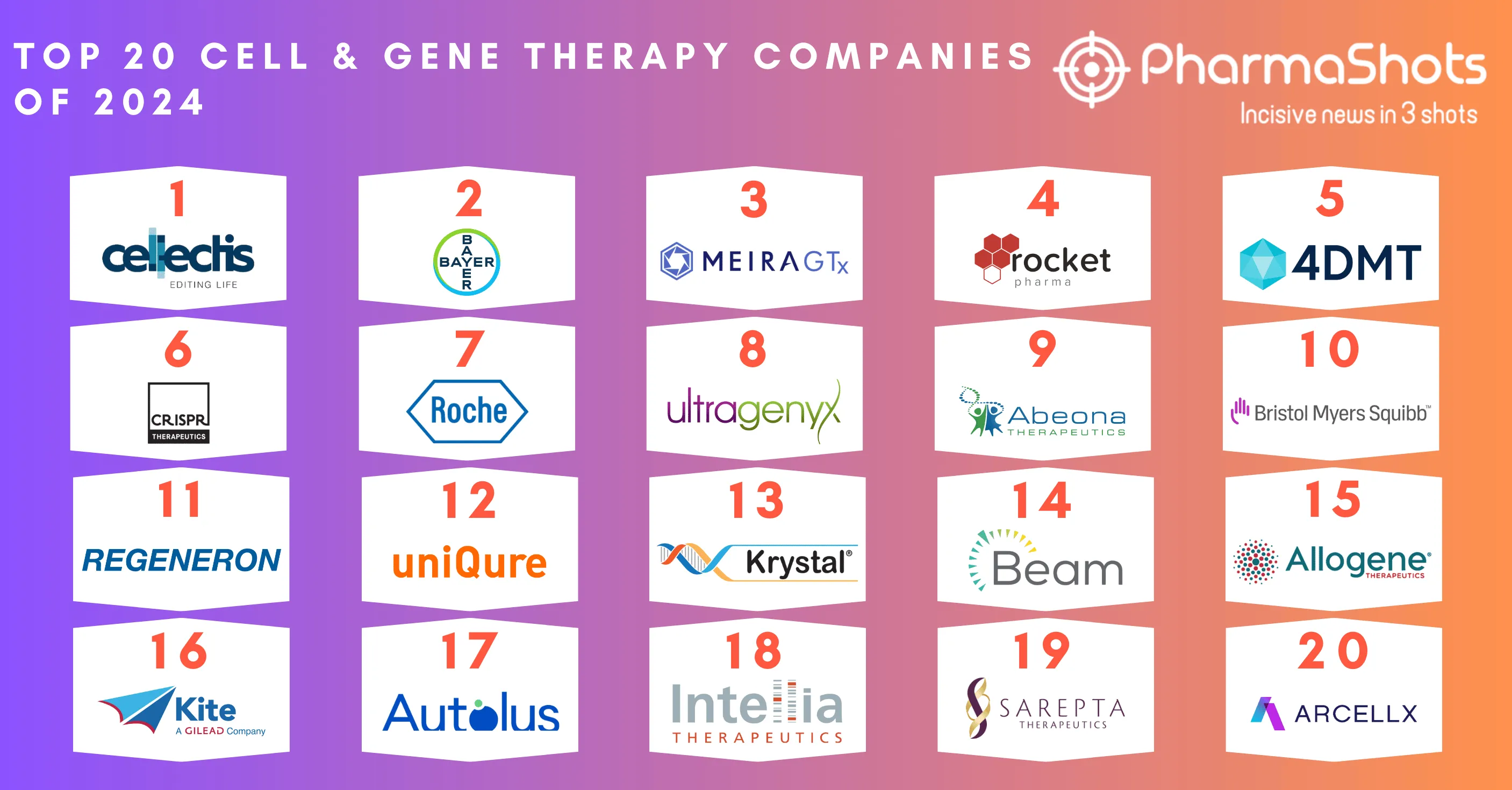

Cellectis’ Development and Commercialization Agreement with AstraZeneca

Deal Date: Nov 1, 2023

Deal Value: $2.44B

-

In Nov 2023, AstraZeneca entered into a collaboration agreement with Cellectis to discover and develop up to 10 cell and gene therapies in Oncology, Immunology Indications, and Rare Diseases

-

The agreement allows AstraZeneca to use Cellectis’ gene editing technologies and manufacturing capabilities to develop novel cell and gene therapy products. As per the agreement, AstraZeneca received the exclusive option to license to develop and commercialize the resulting therapies across the globe

-

Moreover, Cellectis will receive an upfront cash payment of $25M along with equity worth $220M, including an $80M initial payment and $140M during early 2024 at $5 per share and an undisclosed option exercise fee. Additionally, Cellectis is eligible for up to $70M to $220M for each therapy as development and commercial milestone payments, plus tiered royalties

Novartis’ Divesture Agreement with Bausch + Lomb

Deal Date: Jun 30, 2023

Deal Value: $2.45B

-

In Jun 2023, Novartis signed an agreement with Bausch + Lomb to divest its ‘front of eye’ ophthalmology assets, including Xiidra for dry eye disease and investigational drug candidateSAF312 for Chronic Ocular Surface Pain

-

The agreement also includes the rights to Novartis’ AcuStream delivery device for dry eye indications and a pre-clinical TRPV1 antagonist, OJL332. Moreover, the supply of Xiidra will be continued by Novartis on behalf of Bausch + Lomb for a limited period before the closing of the agreement

-

Novartis will receive an upfront cash payment of $1.75B and is also eligible to receive up to $750M as sales milestones for Xiidra, SAF312 (libvatrep), and OJL332

C4 Therapeutic’s Development and Commercialization Agreement with Merck

Deal Date: Dec 12, 2023

Deal Value: $2.5B

-

In Dec 2023, C4 Therapeutics signed a collaboration agreement with Merck. Under the terms of the agreement, Merck received the exclusive rights to develop and commercialize Degrader-Antibody Conjugates (DACs), designed to target and neutralize diseases-causing proteins in cancer cells

-

Both companies would jointly develop DACs directed to an exclusive initial undisclosed oncology target. Moreover, C4 was responsible for developing degrader payloads in the discovery phase through its TORPEDO platform, whereas Merck was responsible for developing DACs in the discovery phase and for advancing these candidates through preclinical, clinical development, and commercialization

-

As per the agreement, C4 will receive an upfront payment of $10M, whereas, for the initial oncology target, C4 is eligible for a milestone payment of up to $600M, plus tiered royalties and for 3 optional extended targets, C4 is eligible for undisclosed option exercise fee, milestone, and royalties. Merck has the option to extend to 3 additional targets, upon the exercise of which, C4 would be eligible for payments summing the total deal value to $2.5B

Proxygen’s Multi-Year Agreement with Merck

Deal Date: Apr 5, 2023

Deal Value: $2.55B

-

In Apr 2023, Proxygen entered into a multi-year research collaboration and license agreement with Merck under which Proxygen granted Merck the exclusive rights to co-discover and co-develop molecular glue degrader to the treatment of multiple therapeutic targets

-

The collaboration combines Proxygen's technological capabilities with Merck's expertise in development activities

-

Under the terms of the agreement, Proxygen will receive an undisclosed up front and is eligible to receive an aggregate of $2.25B in research, development, and commercial milestones, plus undisclosed royalties

Aspect Biosystems’ Development and Commercialization Deal with Novo Nordisk

Deal Date: Apr 12, 2023

Deal Value: $2.67B

-

Aspect signed a collaboration agreement with Novo Nordisk in Apr 2023 to develop bio-printed tissue therapeutics to replace, repair, or supplement biological function within the body

-

Aspect granted Novo Nordisk the exclusive rights to develop and commercialize up to 4 bio-printed tissue therapies globally through Aspect's bioprinting technology with Novo's expertise and technology for the treatment of diabetes and obesity

-

Under the terms of the agreement, Aspect received an upfront payment of $75M along with an undisclosed R&D funding and convertible note financing. Moreover, Aspect is also eligible to receive up to $650M in development, regulatory, and commercial milestones for each therapy, plus tiered royalties

For full report, reach out to us at connect@pharmashots.com

Related Post: Top 20 Biopharma M&A of 2023 by Total Deal Value

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.